Wednesday, December 28, 2011

What is the Goal?

New Models and New Vision bring CONFLICT. What does America look like beyond Capitalism? And how do we get there from here? A-Z

Saturday, December 24, 2011

New Legal Corporations for Social Entrepreneurs

From the Wall Street Journal

- RUNNING A BUSINESS

- DECEMBER 12, 2011, 12:42 P.M. ET

By KYLE WESTAWAY

You may have noticed the emerging class of "social entrepreneurs" who are creating companies that seek profit but also are devoted to a social purpose, to create long term, sustainable value.

About the Author

Kyle Westaway is founding partner of Westaway Law in New York, and cofounder of Biographe, a sustainable style brand that employs survivors of the commercial-sex trade. He lectures on social-enterprise law at Harvard Law and Stanford Law, and launched socentlaw, a legal blog for social entrepreneurs.

Social entrepreneurs believe a business can be a part of the solution to some of the world's greatest challenges. It's this kind of thinking that has given rise to such mission-driven companies as Better World Books, TOMS Shoes, D-Light Design and Warby Parker, to name a few.

But, until recently, social entrepreneurs would find themselves in the position of choosing whether to organize either as a for-profit company or a nonprofit organization. The problem was that sometimes a company would be too much of a business to be a nonprofit. Yet, it also might be too mission-driven to be a for-profit.

Fortunately, there are a few innovative legal structures designed for entrepreneurs who are driven as much by mission as money. The cost of using one of these new legal structures will vary depending on lawyer fees, but generally those fees shouldn't exceed more than $10,000 for a start-up with fewer than 10 employees.

Here's an overview:

L3C

Ideal for: companies that want to blend traditional capital with "philanthropic" capital, such as from foundations

Available to start-ups in: Vermont, Michigan, Wyoming, Utah, Illinois, North Carolina, Louisiana, Maine and soon in Rhode Island.

The Low Profit Limited Liability Company is a new class of LLC for mission-driven companies.

An L3C offers the same liability protection and pass-through taxation as an LLC. But it must be organized primarily for a charitable purpose – and secondarily for profit. Unlike a traditional nonprofit, it may distribute its profits to owners.

The L3C is designed to attract both traditional investment and a very specific type of philanthropic money called Program Related Investments (PRI). PRI is capital – in the form of equity or debt – from a foundation to a for-profit company that is doing work in line with the charitable purpose of the foundation.

BENEFIT CORPORATION

![[SBglobe]](http://si.wsj.net/public/resources/images/OB-QY251_SBglob_D_20111209144956.jpg) Getty Images

Getty ImagesIdeal for: companies that want to create a measurable positive impact while and providing greater transparency to the public

Available to start-ups in: Maryland, Vermont, Virginia, New Jersey, Hawaii, California and soon New York

The Benefit Corporation is a new class of corporation with a corporate purpose to create public benefit, a broader fiduciary duty and is transparent about its overall social and environmental performance.

By definition, it must operate for the general public benefit – defined as a material positive impact on society and the environment. Every benefit corporation is required to publish an assessment using an independent, third-party assessment tool. To create a material positive benefit, a benefit corporation operates in a manner that not only creates value for the company's shareholders, but also its community, environment, employees and suppliers.

The structure also calls for a high level of transparency and accountability. Within 120 days after the end of each fiscal year, a benefit corporation is required to publish a "Benefit Report," which states how it performed that year on a social and environmental axis.

FLEXIBLE-PURPOSE CORPORATION

Ideal for: companies seeking to do good on their own terms

Available to start-ups in: California

The Flexible Purpose Corporation a new class of corporation that creates the maximum amount of flexibility for socially/environmentally conscious companies. It is designed for businesses that want to pursue profit along with a special purpose of its own designation.

The structure allows the designation of a special purpose that the company will pursue in addition to profit. For example, a flexible purpose corporation might be a for-profit developer that has a special purpose of building a public park in each of its developments.

This type of corporation must issue an annual report that is available to the public and provides details on the following: the special purpose; the annual objectives that it has set to achieve its special purpose; the metrics used to gauge the success of the special purpose; how it has achieved or fallen short of the stated objectives; and how much money was spent in furtherance of the special purpose. But it does not require any measurement against an independent third-party standard.

Friday, December 23, 2011

The Secret of Oz - Winner, Best Docu of 2010 v.1.09.11

Friday, December 02, 2011

Book Talk: John Palfrey on Intellectual Property Strategy

The cutting edge of Intellectual Property Minds speak to the practical application of the IP Law and strategy. John Palfrey — Henry N. Ess Professor of Law and Vice Dean for Library and Information Resources at Harvard Law School — discusses his new book, Intellectual Property Strategy (MIT Press), which argues for strategies that go beyond the traditional highly restrictive "sword and shield" approach, including Jonathan Zittrain, Lawrence Lessig, Phil Malone, Terry Fisher, and Eric von Hippel.

Monday, November 28, 2011

George Soros and the Open Society

In his Open Society Lectures in 2009, George Soros presently and accurately described the exact nature of our current historical position in a series of philosophical lectures in Budapest, Hungry. I now understand that Soros is not just a great capitalist, a great philanthropist, and a great intellect, he may go into history as one of the 21st century's greatest political philosophers.

I highly recommend this five part lecture series, produced at Central European University, to anyone who is serious about understanding the world we live in. If you are interested in politics, the economy, philosophy, or the best investment for your money, there is something to learn from George Soros. He will no doubt one day be held in the same regard as Andrew Carnegie or the Rockefellers, as one of the most influential people in the fields of economics, philanthropy, and public education.

Watch the Soros Lecture Series:

In Budapest, presented by Central European University. With Collin McGinn, Philosophy of the Mind.

The Open Society Foundations work to build vibrant and tolerant democracies whose governments are accountable to their citizens. To achieve this mission, the Foundations seek to shape public policies that assure greater fairness in political, legal, and economic systems and safeguard fundamental rights. On a local level, the Open Society Foundations implement a range of initiatives to advance justice, education, public health, and independent media. At the same time, we build alliances across borders and continents on issues such as corruption and freedom of information. The Foundations place a high priority on protecting and improving the lives of people in marginalized communities.

Also see Sacred Economics

I highly recommend this five part lecture series, produced at Central European University, to anyone who is serious about understanding the world we live in. If you are interested in politics, the economy, philosophy, or the best investment for your money, there is something to learn from George Soros. He will no doubt one day be held in the same regard as Andrew Carnegie or the Rockefellers, as one of the most influential people in the fields of economics, philanthropy, and public education.

Watch the Soros Lecture Series:

In Budapest, presented by Central European University. With Collin McGinn, Philosophy of the Mind.

The Open Society Foundations work to build vibrant and tolerant democracies whose governments are accountable to their citizens. To achieve this mission, the Foundations seek to shape public policies that assure greater fairness in political, legal, and economic systems and safeguard fundamental rights. On a local level, the Open Society Foundations implement a range of initiatives to advance justice, education, public health, and independent media. At the same time, we build alliances across borders and continents on issues such as corruption and freedom of information. The Foundations place a high priority on protecting and improving the lives of people in marginalized communities.

Also see Sacred Economics

Saturday, October 22, 2011

Saturday, October 01, 2011

Sheared by the Shorts:

How Short Sellers Fleece Investors

Friday 30 September 2011

by: Ellen Brown, Truthout | News Analysis

"Unrestrained financial exploitations have been one of the great causes of our present tragic condition." -President Franklin D. Roosevelt, 1933

Why did gold and silver stocks just get hammered, at a time when commodities are considered a safe haven against widespread global uncertainty? The answer, according to Bill Murphy's newsletter LeMetropoleCafe.com, is that the sector has been the target of massive short selling. For some popular precious metal stocks, close to half the trades have been "phantom" sales by short sellers who did not actually own the stock.

A bear raid is the practice of targeting a stock or other asset for take-down, either for quick profits or for corporate takeover. Today, the target is commodities, but tomorrow it could be something else. When Lehman Brothers went bankrupt in September 2008, some analysts thought the investment firm's condition was no worse than its competitors'. What brought it down was not undercapitalization, but a massive bear raid on 9/11 of that year, when its stock price dropped by 41 percent in a single day.

A bear raid is the practice of targeting a stock or other asset for take-down, either for quick profits or for corporate takeover. Today, the target is commodities, but tomorrow it could be something else. When Lehman Brothers went bankrupt in September 2008, some analysts thought the investment firm's condition was no worse than its competitors'. What brought it down was not undercapitalization, but a massive bear raid on 9/11 of that year, when its stock price dropped by 41 percent in a single day.

The stock market has been plagued by these speculative attacks ever since the four-year industry-wide bear raid called the Great Depression, when the Dow Jones Industrial Average was reduced to 10 percent of its former value. Whenever the market decline slowed, speculators would step in to sell millions of dollars worth of stock they did not own, but had ostensibly borrowed just for purposes of sale, using the device known as the short sale. When done on a large enough scale, short selling can force prices down, allowing assets to be picked up very cheaply.

Another Great Depression is the short seller's dream, as a trader recently admitted on a BBC interview. His candor was unusual, but his attitude is characteristic of a business that is all about making money, regardless of the damage done to real companies contributing real goods and services to the economy.

How the Game Is Played

Here is how the short-selling scheme works: stock prices are set by traders whose job is to match buyers with sellers. Short sellers willing to sell at any price are matched with the lowest buy orders to create a sale. Since stock prices are set according to supply and demand, when sell orders overwhelm buy orders, the price drops. The short sellers then buy the stocks back at the lower price and pocket the difference. Today, speculators have to drop the price only enough to trigger the automatic stop loss orders and margin calls of the big mutual funds and hedge funds. A cascade of sell orders follows, and the price plummets.

Where do the shorts get the shares to sell into the market? As Jim Puplava explained on FinancialSense.com on September 24, 2011, they "borrow" shares from the unwitting true shareholders. When a brokerage firm opens an account for a new customer, it is usually a "margin" account - one that allows the investor to buy stock on margin, or by borrowing against the investor's stock. This is done although most investors never use the margin feature and are unaware that they have that sort of account. The brokers do it because they can "rent" the stock in a margin account for a substantial fee - sometimes as much as 30 percent interest for a stock in short supply. Needless to say, the real shareholders get none of this tidy profit. Worse, they can be seriously harmed by the practice. They bought the stock because they believed in the company and wanted to see its business thrive, not dive. Their shares are being used to bet against their own interests.

There is another problem with short selling: the short seller is allowed to vote the shares at shareholder meetings. To avoid having to reveal what is going on, stock brokers send proxies to the "real" owners as well; but that means there are duplicate proxies floating around. Brokers know that many shareholders won't go to the trouble of voting their shares; and when too many proxies do come in for a particular vote, the totals are just reduced proportionately to "fit." But that means the real votes of real stock owners may be thrown out. Hedge funds may engage in short selling just to vote on particular issues in which they are interested, such as hostile corporate takeovers. Since many shareholders don't send in their proxies, interested short sellers can swing the vote in a direction that hurts the interests of those with a real stake in the corporation.

Lax Regulation

Some of the damage caused by short selling was blunted by the Securities Act of 1933, which imposed an "uptick" rule and forbade "naked" short selling. But both of these regulations have been circumvented today.

The uptick rule required a stock's price to be higher than its previous sale price before a short sale could be made, preventing a cascade of short sales when stocks were going down. But in July 2007, the uptick rule was repealed.

The regulation against "naked" short selling forbids selling stocks short without either owning or borrowing them. But an exception turned the rule into a sham when a July 2005 SEC ruling allowed the practice by "market makers." A market maker is a bank or brokerage that stands ready to buy and sell a particular stock on a continuous basis at a publicly quoted price. The catch is that market makers are the brokers who actually do most of the buying and selling of stock today. Ninety-five percent of short sales are done by broker-dealers and market makers. Market making is one of those lucrative pursuits of the giant Wall Street banks that now hold a major portion of the country's total banking assets.

One of the more egregious examples of naked short selling was relayed in a story run on FinancialWire in 2005. A man named Robert Simpson purchased all of the outstanding stock of a small company called Global Links Corporation, totaling a little over one million shares. He put all of this stock in his sock drawer, then watched as 60 million of the company's shares traded hands over the next two days. Every outstanding share changed hands nearly 60 times in those two days, although they were safely tucked away in his sock drawer. The incident substantiated allegations that a staggering number of "phantom" shares are being traded around by brokers in naked short sales. Short sellers are expected to cover by buying back the stock and returning it to the pool, but Simpson's 60 million shares were obviously never bought back to cover the phantom sales, since they were never on the market in the first place. Other cases are less easy to track, but the same thing is believed to be going on throughout the market.

Why Is It Allowed?

The role of market makers is supposedly to provide liquidity in the markets, match buyers with sellers, and ensure that there will always be someone to supply stock to buyers or to take stock off sellers' hands. The exception allowing them to engage in naked short selling is justified as being necessary to allow buyers and sellers to execute their orders without having to wait for real counterparties to show up. But if you want potatoes or shoes and your local store runs out, you have to wait for delivery. Why is stock investment different?

It has been argued that a highly liquid stock market is essential to ensure corporate funding and growth. That might be a good argument if the money actually went to the company, but that is not where it goes. The issuing company gets the money only when the stock is sold at an initial public offering (IPO). The stock exchange is a secondary market - investors buying from other stockholders, hoping they can sell the stock for more than they paid for it. In short, it is gambling. Corporations have an easier time raising money through new IPOs if the buyers know they can turn around and sell their stock quickly; but in today's computerized global markets, real buyers should show up quickly enough without letting brokers sell stock they don't actually have to sell.

Short selling is sometimes justified as being necessary to keep a brake on the "irrational exuberance" that might otherwise drive popular stocks into dangerous "bubbles." But if that were a necessary feature of functioning markets, short selling would also be rampant in the markets for cars, television sets and computers, which it obviously isn't. The reason it isn't is that these goods can't be "hypothecated" or duplicated on a computer screen the way stock shares can. Short selling is made possible because the brokers are not dealing with physical things, but are simply moving numbers around on a computer monitor.

Any alleged advantages to a company or asset class from the liquidity afforded by short selling are offset by the serious harm this sleight of hand can do to companies or assets targeted for take-down in bear raids. With the power to engage in naked short sales, market makers have the market wired for demolition at their whim.

The Need for Collective Action

What can be done to halt this very destructive practice? Ideally, federal regulators would step in with some rules; but as Jim Puplava observes, the regulators seem to be in the pockets of the brokers and are inclined to look the other way. Lawsuits can have an effect, but they take money and time.

In the meantime, Puplava advises investors to call their brokers and ask if their accounts are margin accounts. If so, get the accounts changed, with confirmation in writing. Like the "Move Your Money" campaign for disciplining the Wall Street giants, this maneuver could be a nonviolent form of collective action with significant effects if enough investors joined in. We need some grassroots action to rein in our runaway financial system and the government it controls, and this could be a good place to start.

This work by Truthout is licensed under a Creative Commons Attribution-Noncommercial 3.0 United States License.

Thursday, September 29, 2011

Capitalism's End - From Russian TV's Cross Talk

Imagine an alien comes to earth and asks us "What is Capitalism?", and gets 7-Billion different answers".

Wednesday, September 21, 2011

Sunday, August 28, 2011

The Feds Secret Loans, part 2

Bloomberg keeps filing F.O.I.A. requests to find out what the Federal Reserve wants kept secret. Fed Chairman Ben S. Bernanke’s unprecedented effort to keep the economy from plunging into depression included lending banks and other companies as much as $1.2 trillion of public money, about the same amount U.S. homeowners currently owe on 6.5 million delinquent and foreclosed mortgages.

SECRET Foreign Borrowers

It wasn’t just American finance. Almost half of the Fed’s top 30 borrowers, measured by peak balances, were European firms. They included Edinburgh-based Royal Bank of Scotland Plc, which took $84.5 billion, the most of any non-U.S. lender, and Zurich-based UBS, which got $77.2 billion. Germany’s Hypo Real Estate Holding AG borrowed $28.7 billion, an average of $21 million for each of its 1,366 employees.

Timeline of Bloomberg's lawsuit against the Fed

- May 21, 2008: Bloomberg files a Freedom of Information Act request. The Fed denies this request

- Nov. 7, 2008: Bloomberg files suit to require disclosure [Bloomberg LP v. Federal Reserve, U.S. District Court, Southern District of New York (Manhattan)].

- Aug. 24, 2009: Judge Loretta Preska rules that the Fed must disclose this information

- Sept. 30, 2009: Fed appeals decision

- Jan. 12, 2010: U.S. Court of Appeals hears oral arguments

- March 19, 2010: Appeals court upholds Preska decision

- May 4, 2010: Fed and Clearing House ask full U.S. Court of Appeals to overturn Preska ruling

- Aug. 23, 2010: Full appeals panel refuses to overturn Preska ruling

- Aug. 27, 2010: Court of Appeals gives Federal Reserve 60 days to decide on taking the case to the Supreme Court

- Oct. 26, 2010: Federal Reserve decides not to join the Clearing House Association in asking the Supreme Court to consider an appeal.

- Feb. 19, 2011: U.S. Solicitor General recommends the Supreme Court reject the Clearing House's appeal.

- March 21, 2011: Supreme Court rejects appeal and orders release of bank loan data

The interactive graphics are wonderful. Check out the story in the Atlantic, too.

From an accounting perspective, the loan programs shrank, excess reserves were retired, and the Fed simultaneously reprinted money to purchase the MBS and Treasury securities. It did not borrow money from commercial banks. Put another way, the money printed to fund the emergency loan programs, and more, was morphed into MBS and Treasury securities and this is clearly shown in a chart of the Fed’s assets: http://www.cumber.com/content/misc/fed.pdf

Think about it. Where would the excess reserves come from that banks held with the Federal Reserve, if the Fed hadn’t originally made the emergency loans or subsequently purchased assets? If Mr. Melloan’s analysis were correct, the excess reserves, which are assets to the private banking system, would have had to come from shrinkage of their assets and deposits, thereby turning required reserves into excess reserves, or by keeping their balance sheets the same size and shifting the composition of their assets by reducing loans and securities and increasing their reserves at the Federal Reserve.

Just before the crisis in August 2007, banks held only $45 billion in total reserves, and $40 billion of that was in the form of required reserves. Clearly, shrinkage of deposits could not have funded the huge increase in excess reserves in the banking system that came with the Fed’s emergency lending programs. What about a shift in the composition of bank assets from loans and securities to deposits at

the Fed? Data show that while bank loans have declined by about $600 billion, securities holdings have increased by about $600 billion. Therefore, the so-called borrowing from commercial banks could not have come from declines in their securities and loans.

So, George Melloan has totally mis-characterized the source of funding for the Federal Reserve’s QE1 and QE2 asset purchases. The Fed first printed high powered money through its emergency lending programs and as those programs were phased out the Fed again purchased agency mortgage-backed securities and Treasuries from the public by printing money, and the proceeds of those purchases show up as customer

deposits in banks, with the offsetting asset being not new loans but excess reserves held at the Fed.

In conclusion, the whole crisis has simply redivided the pie, and shifted debt from private banks to the US public by 'printing' money and thus reducing the value of US currency. This shifts value out of tangible goods while keeping the ratios of wealth steady. As real value bounces back, only those with capital will be in position to buy up resources. As the commoners have no capital, and the governments are in deep debt, the only people with capital will be private banks, owned by the wealthy.

Tuesday, August 23, 2011

Tuesday, August 09, 2011

A Roadmap to a Life that Matters - Umair Haque - Harvard Business Review

Looks like even those at the Harvard Business Review are beginning to gain enlightenment.

A Roadmap to a Life that Matters - Umair Haque - Harvard Business Review

Now, my little principle might cause those with hand-made suits and beancounterly tendencies to leap out of their chairs and hit me with the tarantallegra jinx. But even the cynics might be willing to admit: given a mysteriously non-recovering "recovery" for a global economy perpetually poised on the brink of perma-crisis, the status quo's out of ideas, out of options, and running out of time.

In an economy dedicated to the pursuit of more, bigger, faster, cheaper, nastier, the greatest hidden cost and unintended consequence is that something vital, enduring, resonant, and animating has gone missing from our lives — and it might just be the biggest thing: meaning in what we do, and why we're here. -

Umair Haque

It is obvious that there are no easy answers, but I suspect that cooperation, courage, and compassion, are becoming survival skills, putting even the scared, cynical competitors with business degrees on the verge of extinction.

A Roadmap to a Life that Matters - Umair Haque - Harvard Business Review

Monday, July 25, 2011

Intelectual Ventures = Patent Troll, Extortionists

Nathan Myhrvold is a genius and a polymath. He made hundreds of millions of dollars as Microsoft's chief technology officer, he's discovered dinosaur fossils, and he recently co-authored a six-volume cookbook that "reveals science-inspired techniques for preparing food." Myhrvold has more than 100 patents to his name, and he's cast himself as a man determined to give his fellow inventors their due. In 2000, he founded a company called Intellectual Ventures, which he calls "a company that invests in invention."

Nathan Myhrvold destroys technological innovation and scientific creativity. His corporation, Intellectual Ventures (e.g. Computing Platforce, LLC., or Quan Holdings, Enhanced Software, LLC) buys up thousands of patents, shuffles them through a series of shell-corporations, and uses them to hide what they are doing. Nathan claims he is defending inventors ... so why hide?

In the interview, the Chief Council of I.V. couldn't even tell the producers when they bought a particular patent from Chris Crofford the patent inventor. Thom Ewing said they might likely be independently owned interested parties, i.e. they get a cut of the back-end arrangement for a percentage, e.g. a cut of the lawsuits.

They buy up thousands of patents and sue giant companies like Apple and Google to "monetize" and "Realize the Value" of the intellectual property. In other words they EXTORT MONEY from those who can afford, and give nothing to the inventors.

This American Life and Planet Money uncover the broken nature of our US Patent System, that issues duplicate patents for things like "Thermally Refreshing Bread" (i.e. Toast, 2000).

The patent process actually stifles innovation because they are so broad that everyone must break patents to do everything they want to do on the internet. The lawyers destroy our world.

A mysterious corporation: Oasis Research, 104 East Houston Street, suite 190, Marshal, TX, which has no employees, is a shell that owns many other mysterious corporations such as Bulletproof and Jellyfish, that create legal firewalls between the 'owners' of the patents and the potential legal accountability that is somewhere in the future. Just another beautiful scheme from Texas.

Nathan Myhrvold destroys technological innovation and scientific creativity. His corporation, Intellectual Ventures (e.g. Computing Platforce, LLC., or Quan Holdings, Enhanced Software, LLC) buys up thousands of patents, shuffles them through a series of shell-corporations, and uses them to hide what they are doing. Nathan claims he is defending inventors ... so why hide?

In the interview, the Chief Council of I.V. couldn't even tell the producers when they bought a particular patent from Chris Crofford the patent inventor. Thom Ewing said they might likely be independently owned interested parties, i.e. they get a cut of the back-end arrangement for a percentage, e.g. a cut of the lawsuits.

They buy up thousands of patents and sue giant companies like Apple and Google to "monetize" and "Realize the Value" of the intellectual property. In other words they EXTORT MONEY from those who can afford, and give nothing to the inventors.

This American Life and Planet Money uncover the broken nature of our US Patent System, that issues duplicate patents for things like "Thermally Refreshing Bread" (i.e. Toast, 2000).

The patent process actually stifles innovation because they are so broad that everyone must break patents to do everything they want to do on the internet. The lawyers destroy our world.

A mysterious corporation: Oasis Research, 104 East Houston Street, suite 190, Marshal, TX, which has no employees, is a shell that owns many other mysterious corporations such as Bulletproof and Jellyfish, that create legal firewalls between the 'owners' of the patents and the potential legal accountability that is somewhere in the future. Just another beautiful scheme from Texas.

"Litigation is just licensing by other means." - If companies pay, then more patents are filed. Thus all big corporations have amassed large libraries of patents, to defend themselves against lawsuits, via mutually assured destruction. Thus, if you sue us, then we sue you. But only the largest players can amass such arsenals. So "Intellectual Ventures" shake-down most companies saying, 'It sure would be unfortunate if someone sued you. Why not hire IV to protect you from such suits.'Civil Lawsuits, thousands of lawsuits, by fake corporations owned by lawyers. Makes me want to shower just thinking about it. But in collecting $2-Billion in 'royalties', is the "Troll On Steroids" - Oasis Research (i.e. Intellectual Ventures) helping inventors collect on patents or just extorting protection money? But unless they achieve $35-Billion over he next 10 years, the venture capitalists behind Intellectual Ventures, will not be happy. That's an unnecessary expense, that will be passed on to the customer, destroying every innovative new competitor in the process.

Thursday, July 21, 2011

ACN Investigation

ALL multi-level-marketing schemes are unethical by their very nature. They concentrate wealth in the hands of a few, without fairly sharing the effort to generate that wealth. The pyramid model is very popular, but it charges customers a non-competitive premium in order to fund all the middle men up the chain. It is a scheme to motivate network marketing for inferior products at high cost.

Among dubious Multilevel Marketing corporations like AMWAY and ACN, Avon or Marry Kay, are a few good people trying to figure out how to make money. These entrepreneurs are taught how to sell other people's products and services, because they don't have anything else. But beware, the scheme teaches unethical practices, because you treat people as a means to an end, instead of an end in themselves. Any company that asks you to invest YOUR money up front to gain a 'business opportunity' where you will earn 'residual income' without producing a product or service, is a BAD CORPORATION.

I've written this because of a threat to my own industry (Energy Efficiency and Renewable Energy). American Communications Network, Inc., a phone service company, has begun selling people renewable energy appliances. Beware of ACN collecting homeowner's personal financial information to sell them unnecessary products without properly assessing their building safety or energy needs. All ethical photovoltaic businesses do full home energy audits and building safety inspections, then recommend and encourage energy efficiency remodeling on existing real-estate before installing any renewable energy appliances, like solar panels.

As customers should know ACN, Inc. is not a publicly traded corporation, it is a privately held corporation, so it is beyond SEC control. American Communication Network, Inc. doesn't trade on any SEC regulated stock exchange (note the ACN stock symbol is for a different company, Accenture ).

-Michael Russell

http://www.sdsustainablefuture.com

Saturday, April 30, 2011

Insanity IS Holding Two Opposing Thought In Your Mind

Watch this video about Goldman Sachs, and learn what an UNSUSTAINABLE BUSINESS looks like.

John Stewart interviews William Cohan author of "Money and Power: How Goldman Sachs came to rule the world" on the Daily Show.

John Stewart interviews William Cohan author of "Money and Power: How Goldman Sachs came to rule the world" on the Daily Show.

Monday, April 11, 2011

Inflation Is GOOD for the Economy

Holding Inflation below five-percent (5%) actually decreases capital available necessary for a healthy economy, i.e. 100% employment. So, why do central banks all over the world (i.e. The Federal Reserve) have policies that try to hold inflation as close to zero as possible? Because those with capital investments gain from predictable markets (i.e. no innovations) and inflation competes with their return on investment. Ideal inflation should stay in flux between 5%-10% to create markets that have maximum employment and productivity. (Caveat- if your markets are hot and maximized the competition tends to create its own problems, like environmental degradation and corrupt business practices that require government regulation because their solutions are not profitable) If you want to make money - you need to create things, real-property that can be traded for currency. The danger is that only those with capital have the industrial foundation to make stuff efficiently enough to be competitive. The only things that you can create without physical capital, are ideas, and those require sharing to become useful.

From THE REAL NEWS NETWORK interview with Ha-Joon Chang author of "23 Things they don't tell you about Capitalism"

Wednesday, April 06, 2011

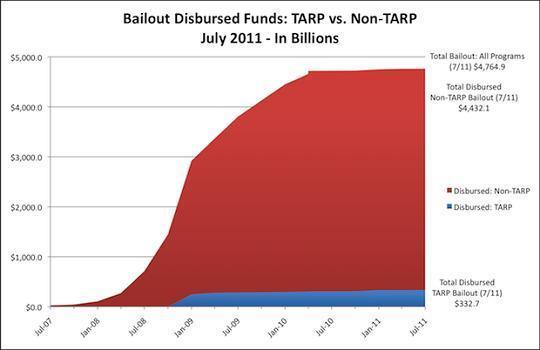

The Primary Dealer Credit Facility = $9-Trillion+

The Primary Dealer Credit Facility - according to CNN Money and ProPublica, the total extent of this UNDISCLOSED Federal Reserve 'Emergency' (no-interest) Loan program between May 2008 & 2009, was $9-Trillion, and although $7-trillion of the PRINCIPAL has been 'repaid', this represents an increase in the money supply of ~$90-T. Meaning the US$ is worth 1/3 less today than in '08. Has your salary, home equity, or the value of investments risen by 33% in the last three years? If so, you are a winner of this game. Also, the Banks gave bonuses as a result of this 'increase' in capital and lend the money to corporations at interest, creating debt of nothing, and that expense is passed on to the consumer as a cost of business. If they had failed to pay back these 'loans' the US Taxpayer would have been responsible, via an increase in US National Debt. (so much for pocket change of the $700-B TARP, and $800-B 'Stimulus')

http://money.cnn.com/2010/12/01/news/economy/fed_reserve_data_release/index.htm

http://projects.propublica.org/tables/treasury-facilities-loans

http://money.cnn.com/2010/12/01/news/economy/fed_reserve_data_release/index.htm

http://projects.propublica.org/tables/treasury-facilities-loans

Tuesday, March 29, 2011

Napoleon Hill Think and Grow Rich Three-Going The Extra Mile

Napoleon Hill - Think And Grow Rich - The Extra Mile = Free Labor

Subscribe to:

Posts (Atom)